After I did my few entries on the currencies in Why oil price went up? and Is USD on free fall?, I wondered,"what about Malaysia?"

In my last up-date on Malaysia in How is the market judgement on PRU15 of Malaysia during December 2022, I have noted a little up-side while a higher potential for further slide in KLSE. At the same time, I have found it interesting that MYR was in fact strengthening against the USD, of course with a possibility of correction before further downward movement (meaning MYR strengthening against USD).

KLSE did climb further but with the multiple level of moving averages resisting on its path, the upthrust is weak.

What about the MYR then?

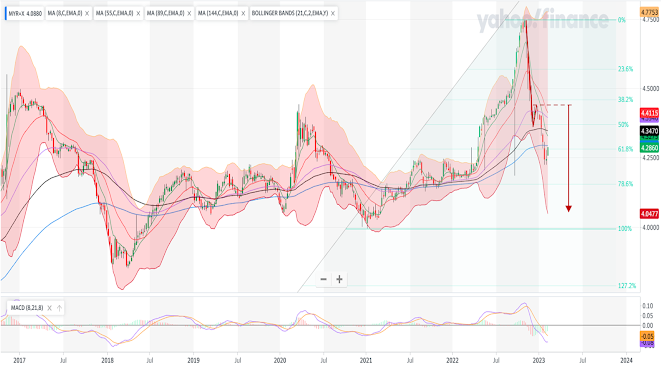

USD actually failed to further correct and continued on the downslide against MYR. It has broken through the 144-week moving average and presently testing the moving average support turned resistance, coincidentally the 61.8% retracement line.

Nevertheless, the mild congestion earlier allows me to use projection to determine the possible supports, which is between 4.0525 to 4.2003. There is one retracement support within this range at 4.1514.

What happen when MYR compares with SGD?

Fig 2. SGDMYR weekly chart

It was really a long time ago when I mentioned SGDMYR in December 2022. It went up, peaked and reversed downward. It paused and presently breaking new low, only to be supported by the 55-week moving average this week.

While having new lows, the body indicates divergence as the body of latest 2 bars are green. Considering the counter is floating right above the 55-week moving average, it is possible for SGDMYR to bounce upward from here.

At the same time, the earlier correction does indicate some more downslides. I see the support levels at between 3.1199 to 3.19397. The target coincides with the 61.8% retracement line at 3.1138.

Labels: MYR, SGDMYR

0 Comments:

Post a Comment

<< Home