Dow Jones, Nikkei and Hang Seng Up-date 24th Sept 2022

It has been a turbulent week for the financial market.

First Putin falsifying the reality lying to his people for reinforcement and threaten the world with nuclear warfare, on the other side, the Federal Reserve rate hike of another 0.75%. This causes uncertainty on the financial market, making it a challenge to predict the market.

I have not done any update on Dow Jones, Nikkei and Hang Seng for quite a while. My last up-date was on 5th Sept 2022 noting the effect of Powell's effect on the market titled the continuing Powell's effect on the indices. While there was also mentioned on the sudden drop of the indices in the sudden plunge of indices last night and present status of currencies, the entry focused more on the currency fluctuation.

I was a little reluctant for the update on the 3 counters the last 2 weeks. For one, it was too short a lapsse time and the counters must be allowed to work their courses.

How have the 3 counters developed the 2 weeks since?

Fig 2. Nikkei 225 Weekly Chart

Even though Nikkei 225 seemingly affected by the drastic drop in Dow Jones, it nevertheless reluctant to follow full heartedly. It is stopped by the 89-week moving average. The situation on Nikkei is not as bad as Dow Jones.

Even dropping below the 89-week moving, there is still one more layer of support at 144-week moving average.

However, based on the counterwave upward, it is possible to see a 3 waves movement with a 3-wave B wave that formed a rectangle. I will still have to assume a possibility of a downward C wave.

Using projection measurement, support level is seen between 23,108 to 25,443. In addition, I can use the same set up for an expansion support at 18,567.

The expansion measurement is quite scary, it is close to a 50% drop from its top at 30,795. On a personal level, I believe that for this to come true, Nikkei has to break the low of 24,681. no matter what it is still one of the possibilities.

what of Hang Seng?

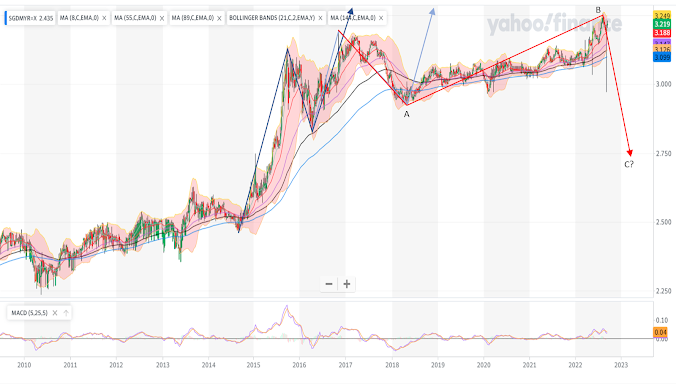

Fig 3. Hang Seng Weekly Chart

I did an entry on Hang Seng monthly chart earlier in The HSI monthly chart. However, I pondered much about its more short-term objectives. First of all, there was a strong rebound, this followed by a more sluggish downward movement. In addition, Hang Seng was reluctant in crossing the previous low.

This let me believe that there is a possibility that Hang Seng might correct before its continuation down trend as I described in the continuing Powell's effect on the indices.

The move this week changes everything. It crossed the previous low, making it more certain of its continuation downward, it is less likely to correct upward.

There are actually 3 set ups that I can use for Hang Seng. There are 2 projections, one of which Hang Seng has reached, lying between 18,838 to 23,553, the next level, 127% projection will support at 15,480.

Using the minor wave measurement, support level at between 15,708 to 18,311. Hang Seng has penetrated the upper end of this zone.

At the present moment, I can also utilize expansion measurement, support level is between 11,420 to 14,023.

Labels: Dow Jones, Hang Seng, Nikkei 225