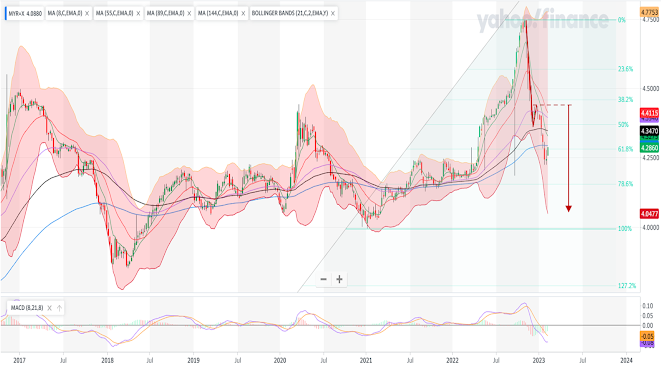

After my last entry Why oil price went up?, I noted USD weakening against SGD, it made me wonder how it is performing against other currencies.

Fig 1. JPY weekly chart

How shall I say this?

Compare to JPY, USD seems to be on a free fall. This is a spike reversal although the the peak bar did not exhibit a single bar (or shooting star candlestick) or 2-bar reversal.

While it fell through 55-week moving average in January 2023 and remained below till now, it nevertheless seems to be losing momentum.

I feel that it is possible that a correction might be in range. However, its 8-week moving average is in process of crossing the 55-week's, we might need to wait a little longer, probably until the 21-week reaching 55-week moving average.

I do not really have any projection read for the time being. So based on the retracement measurement, support level is at about 120.76 to 126.96.

Fig 2. EUR weekly chart

Similar to JPY, USD is also on an apparent free fall against EUR. However, there are more pauses for EUR, making it looks like EUR is with a 5-wave down.

The 8-week moving average has already crossed 55-week's and it is about to reach 89-week's. EUR even crossed the 144-week moving average this week and closed below it. It will be interesting to see if 144-week moving average can continue to resist the counter from going back up.

Using projection, the next support levels are between 0.8584 to 0.8948. At the same time, EUR is about to reach its 61.8% retracement support at 0.9005.

Fig 3. GBP weekly chart

Just looking at the chart, do I need to say more about GBP?

Yes, there is something to say. GBP seems to be the weakest of the 3 currencies. While the other 2 breaking the 55-week moving average, GBP was actually first supported by its 55-week moving average before breaking through the second time.

In fact, the moving averages support for GBP is stronger than that of EUR. As such, can I say that Europe's economy is presently stronger than UK and that the UK market is less attractive to the investers?

Using projection measurement, I can see support at between 0.7522 to 0.7874, coincidentally its 144-week moving average position at the moment.

GBP is again congestion after crossing the 55-week moving average. Making a potential set up for another projection measurement. However, the set-up is incomplete, so I won't be doing the measurement for this just yet.

I am not boasting about my skill set here as there is little skill set needed to set up measurement based on Fibonacci retracement and projection. I am concerned.

USD is actually on some kind of free fall after reaching its peak. If I am to use a metaphore on this, I can only bring in the Super Nova, the final burst of a dying star. It is possible that people are dumping USD! Considering the recklessness of the US politicians taking for granted the world dependency on its currency. I believe that they have not even noticed potential danger ahead of them.

That this point of time, they are still thinking of rising the debt ceiling and taking the easy way out instead of cutting spending. What will happen should USD reach the next level or even lower?

Devaluation of USD can lead to inflation or even hyper-inflation. By then USA will be heading for hardship, worst still, it is bring the world along.

Labels: EUR, GBP, JPY